Factors to Consider While Investing in Crypto

The crypto market constantly fluctuates; however, there are some key factors that crypto investors need to keep in mind while making crypto investments and buying or selling cryptocurrencies. Even though the crypto marketplaces have been in a bear market for several months, there is still a lot of interest in cryptocurrencies. New traders jump into crypto commodities every day. As the market stabilizes, bitcoin investments are only increasing. Therefore, it is crucial to adopt a rigorous plan and focus on knowing the fundamental factors of a coin's value while trading in digital assets like bitcoins. Unfortunately, a growing number of people naively invest, supposing that a friend or a family member has a significant gain after seeing success stories. Everyone would be billionaire crypto if it were easy.

Well, if you are still, why should I invest in cryptocurrency? Then that’s because you are not quite sure about the factor to consider before investing in crypto, but once you know, that might change your thoughts!

Let’s dig in.

This blog can be used as a guideline better to assess the current market and potential risks and opportunities.

Generally, when you are looking for the best cryptocurrencies to invest in, two main factors that should lure you in:

1) Market capitalisation: 153,000,000 (BTC’s Market Cap)

2) Liquidity level: High/Good

3) The History Behind the Currency

4) Frequency of Fluctuations

5) Transaction Speed and Cost

6) Top Coins most people are investing in

7) Crypto updates on unbiased websites like TTC

1. Market Capitalisation

This refers to the sum value of Bitcoin or altcoins calculating in the market. You should opt to buy a cryptocurrency with a high market cap as it signifies that the coin has a high trading volume, which is a positive sign. In addition, it means that more people are more into a crypto investment, exchanging, purchasing, and selling the token in the crypto exchanges.

A top cryptocurrency will often hold a higher position in the coin charts by market cap. However, it doesn’t mean that an altcoin below 20th place is necessarily a lousy cryptocurrency investment. After all, the market cap is only one factor that can help you make a purchase decision. But if you’re a beginner, it may be an excellent primary basis to get you started as a token’s relevance (evidenced by a high market cap) lowers its risk of losing value due to public disinterest.

Market capitalization enables you to analyze the overall worth of one crypto to another, allowing you to make better intelligent trading selections. The market cap is a helpful statistic for evaluating the entire value of digital currencies, but when assessing threats of any transaction market trends, stability of cryptocurrency and monetary status of your own must all be taken into account.

2. Liquidity Level: High/Good

The liquidity level indicates how easy and fast it is to exchange cryptocurrency tokens for cash or a different type of digital currency. A coin’s liquidity increases if it has a high trading volume, is widely accepted, and isn’t heavily restricted. Generally, any token in the major exchanges qualifies for this factor. However, you may want to be concerned about lesser known altcoins when investing in cryptocurrency, as crypto exchanges might not support these assets yet.

The best situation for all traders is when the market is highly liquid. This means improved prices for agents and dealers because the size and quantities of market participants establish a fair commodity value, which can satisfy all players.

More notably, it ensures steady prices on the market, without significant variations in small time spans. If prices are sufficiently constant, huge transactions without significant increases or fluctuations can continue on the marketplace. In this instance, brokers can provide quickly and easily for larger customers and orders.)

3. The History Behind the Currency

Cryptocurrencies have a high degree of volatility. This is because of speculations, hype, pumping and dumping systems, and the absence of regulation. However, looking at the price history of a currency reveals a clear guideline about that currency.

Usually, lower market currencies are more vulnerable to pumping and dumping. An investor who acknowledges this can prevent unnecessary loss.

The currency price may also link with other prices for coins, shopping, or international events. For instance, when Bitcoin price rises quickly, most alternatives lower their prices. This is because Bitcoin is the leading coin utilized for trading other altcoins. A rise in Bitcoin purchases results in an increase in altcoin sales. This pushes up and down Bitcoin's value.

The amount of transactions on which the coin is currently exchanged is a pivotal element to check. For example, is the coin on most big platforms available or only minor ones?

Value can be affected by reports concerning the addition of coins to large trading networks like Binance.

4. Frequency of Fluctuations

The value of bitcoin fluctuates due to numerous risks and profits. At times, this price deals with various highs and lows based on the market availability and demands. About four years ago, the Bitcoin value changed continuously.

Sometimes it was US$900, and then it was USD20,000. Sometimes it was US$900. And it fell dramatically at some point. Meanwhile, the situation has considerably changed, and cryptocurrencies are now part of the global industry. It, however, does not mean that some hazards do not occur.

5. Transaction Speed and Cost

Transaction speed and network traffic are the fundamental problems facing the major cryptocurrencies.

First, let us contextualize the enormity of the challenge. Only five transactions per second may be processed using bitcoin. Compare the 1,700 transactions per second to those of Visa payment gateway.

In addition, Bitcoin payments have to wait for another block to pass, meaning it may take ten minutes to verify a purchase.

Take time to think about how you're paying for food. It's immediate, free, and confidential if you choose to pay with cash. If you pay by credit card or debit card, it is quick, cost effective, but not private, leaving a trail for your purchase. When do you choose Bitcoin to pay? Slow, costly, but private.

Let us now look from the point of view of the merchant. Cash can be processed as quickly as the cashier can and is efficiently free. Visas are straightforward, remove the risk of poaching personnel, and are affordable.

6. Top Cryptocurrencies People Trust

In recent times, Bitcoin has become the industry buzz. The standard of cryptocurrency has now become a factor. The recent rise in digital currencies certainly attracts considerable interest from ordinary traders shifts from the conventional space. While Bitcoin is an obvious alternative for investors to heat up to space, some look to make their portfolio even cheaper yet potential altcoins. An altcoin signifies simply an alternative crypto monetary to Bitcoin for those not knowledgeable. And they all function following their regulations.

Another important factor is looking at the current “top coins” people are buying and the “giants” in the marketplace such as Bitcoin, Ethereum, and Ripple.

1. Bitcoin (BTC)

Bitcoin currency is one of the top cryptocurrencies to invest in due to its novelty and popularity among independent and institutional traders. Most altcoins were created as a response to the gaps in the Bitcoin evolution, but none has acquired the hearts of the mainstream market at the same level as BTC.

More and more billionaires and large companies are putting trust into Bitcoin as its price has continued to rally upward over the years. Its astronomical performance in 2020 (with its massive end of year bull run) triggered optimistic forecasts over the next five years. Some analysts believe that Bitcoin may peak at $100,000 by the end of 2021, making it a no-brainer choice if you’re looking into investing in cryptocurrency. BTC is currently sitting between $36,000 to $39,000 but peaked at over $40,000 in mid-January 2021.

When bitcoin was first invented, it was considered the replacement of fiat currency and will remove the mediator system in the traditional banking system. Unfortunately, due to some deficiency, it cannot become the best replacement for fiat currency, and bitcoin failed as a currency. Price volatility, slow transaction time, no authority to regulate, etc., are the common reasons to get behind in the race.

But every bad thing opens the door for other good things. Bitcoin opens the gate for other cryptocurrencies to solve these problems and come to the race for these problems. Ethereum is one of the most well-known coins, which has all the possibilities to become the replacement as it solves the issues bitcoin has.

Stablecoins is a crypto that is supported by physical assets (such as the US dollar) and employs cutting-edge blockchain technology. These coins are far more appropriate for use as payments since they move only as much as their asset value. So, once again, no one is purchasing bitcoin because of its blockchain technology when there are better alternatives.

The origin of BTC

In 2008, an unidentified person or group of persons named Satoshi Nakamoto established the cryptocurrency. The money was introduced as open-source software and began to be used in 2009.

BTC Pros

- Bitcoin users have complete control over their funds.

- Transfers in Bitcoin are entirely anonymous.

- Bitcoin transfers are carried out on a peer-to-peer method.

- No banking costs are incurred in Bitcoin exchanges.

- Payments via Bitcoin feature affordable international transaction charges.

- Bitcoin transactions are available on the go.

BTC Cons

- Volatility is high, and there is the possibility of big losses.

- Activity in the Black Market.

BTC Integration

A Bitcoin payments method lets dealers accept Bitcoin purchases. Today, most of those payment processors enable several others, such as Ethereum, Litecoin, Ripple, and Bitcoin Cash, to be bought and sold. These are the best solutions. Payment processors make it easy for Bitcoin or other cryptocurrencies to be transferred immediately to fiat.

It makes it feasible for traders to automate these payments and provides numerous instruments and reports to make the entire process as smooth as possible.

Why do People invest in BTC?

Chances to Make a Profit

One reason users are prepared to invest in Bitcoin is that they have heard of Bitcoin holders becoming millionaires overnight. By BTC mining and buying it at a lower price than the one you expect to sell, you can make Bitcoin.

Chances to be Potential

Bitcoin has more than 5 million users, each day more. Because the people receive it very well, many experts anticipate that Bitcoin will grow with time.

More Reliable than Other Cryptos

The Bitcoin revolution encouraged many people worldwide to immerse themselves in this environment and attempt their good fortune. There are, therefore, many more cryptocurrencies on the market, and many want to invest in them. But in fact, Bitcoin does not come close to any other cryptocurrency. Besides, Bitcoin has several advantages over FIAT currencies, it's much higher than other cryptocurrencies.

2. Ethereum (ETH)

Investing in cryptocurrency is very popular nowadays, but it’s also hard to decide which one to go for. Ethereum coin is a highly robust platform that offers more than just a peer-to-peer payment solution for digital currencies. It’s an open-source network developer that can write smart contracts, build decentralized applications, and create cryptocurrencies. A good chunk of altcoins, including EOS and VeChain, started as tokens on Ethereum’s blockchain.

The network also recently began its transition to Ethereum 2.0, aiming to address its most significant issue: scalability.

The first phase occurred in December, coinciding with the Bitcoin-led bull run and giving ETH the leverage it needed to break through the $1,000 milestone. It has only grown in value since then–sitting at over $1,600 as of February 2021.

The origin of ETH

Ether is the platform's indigenous cryptocurrency. It is second only in market capitalization to Bitcoin among cryptocurrencies. The programmer Vitalik Buterin designed Ethereum in 2013. Development began and was funded in 2014, and on 30 July 2015, the network took place live.

ETH Pros

- The cost per coin is reasonable.

- Inflation's lower risk.

- Ethereum is, without a doubt, one of the most liquid assets.

ETH Cons

- Uses the hard language of programming.

- Investing in ethereum can be harmful.

- ETH has scaling problems

ETH Integration

Nowadays, more and more people prefer to pay using Ethereum. As a result, an increasing number of businesses integrate Ethereum as a way of payment.

Why do People invest in ETH?

There are several reasons why people choose to invest in ethereum. One reason is that the price of ethereum has gone up over 3000 percent this year compared to Bitcoin's rise of about 50 percent. Ethereum is also being used by businesses such as Microsoft, UBS, and Intel.

Another reason people choose to invest in ethereum is that it has smart contracts capabilities. If you use ethereum, you can exchange money transparently without paying any fees to mediators. You can also own your identity and electronically sign documents so that they are legally binding.

Use of revolutionary NFT

Nonfungible tokens (NFTs) are ownership certificates for the digital assets sold across the blockchain, such as art, music, and video. They can be purchased and sold on markets such as opensea.io, which just exceeded $1 billion in trading volume monthly. The Ethereum network creates several NFT IDs that ensure that they are unique. Meanwhile, intelligent contracts immediately transfer ownership from the seller to the buyer of the unique NFT ID on receipt of the ETH by the buyer so that it is not possible to take the ETH and bail. As a result, NFTs may catch only 0.01 ETH or millions of dollars.

Introduction to the Decentralized World

The increase of cryptocurrencies has led to the development of infrastructure in cyberspace alone – decentralized applications (dapps). They include financing, games, online casinos, decentralized exchanges (DEX), social networks, insurance, and health care but are not restricted to them. However, their main feature is that there are no core teams or personnel behind any of the applications.

Starting of A New Dawn

By late 2022, Ethereum would go from a Proof of Work (POW) to a Proof of Stake (POS) network, which would cut its energy consumption by more than 99% from present levels. Under this configuration, token holders, not miners, confirm transactions by promising their ETH for lock-up in the pool. Stakeholders can therefore benefit from an appreciation of the capital of their tokens as well as tiny "interest" payments for staking and validating their ETH transactions. While Bitcoin has remained in the spotlight as the top cryptocurrency, investors are increasingly interested in altcoins, which are more scalable to adopt into digital currency. Out of hundreds of altcoins on the market, Ethereum remains the number one choice, second only to Bitcoin by market cap.

3. The People’s Reserve (TPR)

TThe People’s Reserve is a new anchored coin that combines the most delicate features of anchored coins and regular altcoins. If you plan to invest in crypto, you should know that TPR is exchanged at gold's most recent high price, implying that its worth will theoretically never fall. Even though the profit and the price of the coin will not go down due to the gold price is not guaranteed, it is usually unaffected by price swings and does not lose value over time; therefore, market fluctuations make it one of the best cryptocurrencies to invest in 2021.

As a result, TPR is immune to the rapid ups and downs that have become prevalent in the cryptocurrency market, unlike other coins such as BTC and Ethereum currency.

Volatile Issues Between Anchored coins and Traditional Crypto Coin

As an anchored coin, TPR clutches onto an existing physical asset and accepts the maximum point of its value, which is why the coin is equal to gold's latest highest price, making it nearly crash proof. Investing in a coin with no established value can be intimidating. Mother coin of all crypto, the Bitcoin's price soared to $64,000 earlier this year, but after Elon Musk dropped Bitcoin as a payment mechanism from his company, the coin's value plummeted to $48,000 from $56,000.

Anchored coins, on the other hand, will never be as volatile as ordinary cryptocurrencies. The scarcity of gold is a significant factor in its high value. With a finite amount of gold on the planet, its availability is dwindling by the day as mining monopolies pursue the precious metal aggressively. Gold's value acts as a numéraire for all other prices, and because TPR is tied to it, its value is steady and steadily rising.

Why Should You Invest in TPR?

There are plenty of reasons to invest in anchored coins like TPR, which can be a low-risk investment for newcomers because their value is locked to the last highest gold price - a value that usually never decreases. However, as its nature, investing in crypto is quite tricky, and one needs to be careful as this is quite volatile.

People invest in anchored coins to avoid the volatility of its market. But since they don’t offer much, investors consider them as conversion coins just to be in the crypto market by preventing the market’s volatility. On the other hand, TPR could be a valuable asset as it is almost guaranteed to increase in value by each year due to the price of gold being increased every year. And obviously, it will grow more in value as the gold is getting rarer.

Another reason for investing in TPR is its speed and price. Each transaction is processed in as little as 2 seconds—nearly instantly and with virtually no costs! Furthermore, blockchain allows for up to 25 free transactions each day, providing investors with enough leeway to use fee-free sending and receiving capabilities.

The People’s Reserve Potential

TPR can develop and improve each year, as opposed to other cryptos that aspire to be a one-season wonder, TPR aims to build a new economy, one that is backed by a growing network of small company owners who have been using it as an alternative for fiat currency in transactions. TPR was built to resist the seasonal fluctuations of the cryptocurrency market, whether today or in 10 years, with every feature, including its link to gold's peak value.

4. Beyond Protocol

Beyond Protocol is a distributed ledger technology project that provides a secure and potentially unhackable solution for inter/device Internet of Things (IoT) communications. Beyond Protocol platform uses blockchain technology and unique hardware signatures to enable secure messaging between devices and a crypto-based payment gateway for automated transactions with a single line of code. Beyond Protocol strives to develop practical and real solutions for device security and payment within the machine industry. Their goal in developing Beyond Protocol was to create an ideal IoT framework:

- Allows all hardware devices around the world to communicate via a single medium

- Makes it fully decentralized and dynamic, and invites everyone to build

- Last but not least, making hacks impossible

"Our token's release is a milestone for Beyond Protocol," says Beyond Protocol CEO Jonathan Manzi. "We have built a token specifically for mass adoption, tied to how Beyond Protocol's core operates with some of the largest institutions in the world."The $BP token will function within the protocol as a means to compensate validating nodes and incentivize continued investment in the network; these nodes form the backbone of Beyond Protocol and make the service "probabilistically impossible to hack." $BP can be used for value transfer among devices, and for peer-to-peer transactions both on and off-chain."

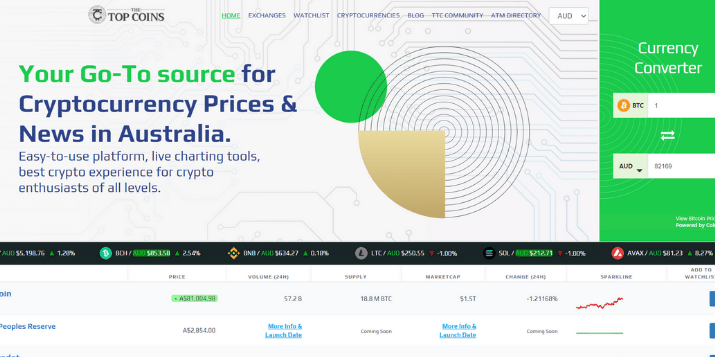

7. Crypto updates on unbiased websites like TTC

If you want to shine in the crypto market, whether you're a rookie or an experienced investor, you'll need to stay up to date on new facts and news about cryptos. Because the market is so unpredictable, even minor news about a coin might cost a lot of money. This is where an unbiased news source, like Thetopcoins.com, can help. TTC is a digital currency news organization dedicated to providing unbiased, high quality, and reliable information on the cryptocurrency market. You will get all kinds of the latest news, crypto market updates, latest prices, and other important information as well.

The Top Coins does not sell any coins and is designed to provide their readers with unbiased and up to date reports. The information we share is data driven and simplified so that our readers can fully understand the intricacies of cryptocurrency.

The Top Coins’ goal is to help you be market ready in this fast changing crypto world.

For anyone new in the crypto space, everything can feel overwhelming. Indeed, there are thousands of coins available in the market. However, not every coin would be worth going after. Therefore, it is essential to cross reference your research to identify the best cryptocurrency to invest in 2021.

Thetopcoin has tons of informative and price prediction content for its readers.

Before investing in any specific crypto, the most crucial part is knowing coins’ comparison. Without knowing the comparative analysis, you cannot know better about various cryptos. Here is a little comparison among the three most popular cryptos (Bitcoin vs. Ethereum vs. Litecoin)

Since Bitcoin was the first blockchain based coin, it distinguishes it from all later initiatives. Altcoins are any cryptocurrencies that aren't Bitcoin, and they're typically designed to address some of Bitcoin's flaws. Litecoin and Ethereum are the most well known altcoins among all the altcoins.

Different cryptocurrencies use different mechanisms and encryption methods. In addition, there are various criteria to distinguish them like mining method, transaction time, market capitalization, supply of coins, price of the coins, etc.

Bitcoin has a 1000% price growth, and ethereum has a 10,000% price growth. On the other hand, litecoin has the same price growth as ethereum in comparison to bitcoin.

Regarding mining, bitcoin uses the SHA-256 hashing method to ensure the safety and proof of work process. Ethereum switched from POW to POS method, but litecoin uses the POW method like bitcoin.

Final Thoughts

Finally, investing in cryptocurrency is kind of tricky, and understanding that a highly speculative field is a digital currency. Many more investors have spent money in the virtual token world for every overnight bitcoin billionaire just to see that money disappear. It is a risk to invest in this space. You contribute to your most excellent chances of success by conducting your homework before investing. The cryptocurrency market can be highly profitable, but it can also bring substantial losses. For this reason, don't invest more than you are willing to lose. Many cryptocurrency investors believe that diversification might not only increase the horizon of cryptocurrency investment and diversify the cryptocurrency portfolio.

Well, it is clear that cryptocurrency will not die because people believe in the cryptocurrency revolution with the coming of bitcoin, ethereum, TPR, ripple currency, and many more virtual tokens. However, before choosing a coin, you need to learn about its market capitalization, liquidity level, fluctuation frequency, transaction speed, cost, etc. These indicate the essential nature of a coin.

After considering the issues mentioned above, topics, and details, you should by now understand how ready you are to invest. So don’t rush and do your research, take time and then invest.

Leave a Reply

33 comments

Add comment ×