BTC, ETH, XRP: 2022 Predictions for Cryptocurrencies

Bitcoin (BTC), Ethereum currency, and Ripple (XRP) are cryptocurrencies that have seen a great deal of hype and speculation over the past few years. While their prices have seen significant volatility, they are still worth looking at as potential investment opportunities for 2022.

Here in The Top Coins, we will explore what could happen with each of these currencies by 2022 and why.

Bitcoin as the Leading Token

The top three price predictions for Bitcoin, Ethereum, and Ripple are as follows: ETH outperforming its peers, BTC struggling, and XRP bearish.

Bitcoin's price has risen dramatically in recent months, hitting an all-time high of $68,000 last November. It began to fall back by the end of last year and stagnated at around $50,000 by now.

Still, Bitcoin's price hitting a new all-time high of $125,000 in January is a significant climb from its starting point of $30,000 in January 2021. Its cost changes dramatically throughout the day and even by the minute. Bitcoin's price began 2022 at around $50,000 and has recently dropped to around $45,000. It has risen back above $50,000 for the first time since December 12th this year.

The Bitcoin bull run came to a halt this week, when the BTC price was pushed lower by the Omicron tale and ensuing market turmoil. ETH, on the other hand, was just $16 away from establishing a new high-water mark in recent days, despite the fact that the majority of other cryptocurrencies have dropped considerably. The price of XRP was purchased at a bargain, but the uptrend hit a brick wall and was stopped in its tracks.

After a drop in momentum that has made Bitcoin fall from favour, it is on the backfoot.

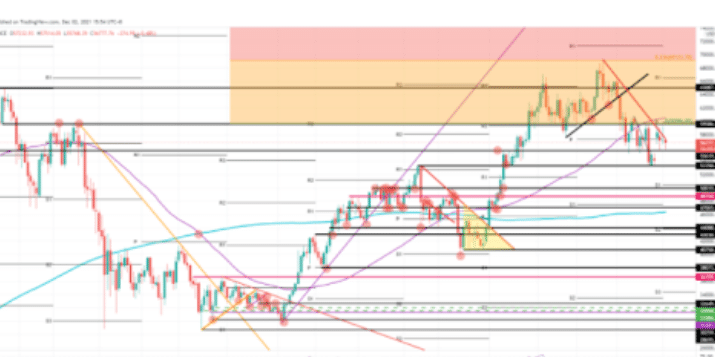

The price of bitcoin (BTC) soared higher at the beginning of the week, brushing aside investors' concerns about the new Covid variant. The BTC price opened up considerably greater than where it had closed on Sunday, creating a gap in the chart. As a rule, gaps fill up sooner rather than later, and on Monday, when bulls witnessed their early gains erased as BTC price retraced to close the gap.

Bears are defending the new monthly pivot of $59,586 in December, which corresponds to a Fibonacci retracement. The RSI has dropped below 50, which signals that bullish demand is on the wane, providing more evidence of this decline.

The current market uncertainty is likely to keep potential investors on the sidelines. Although the crimson downward trend line is shattered, it is still significant. Investors will probably only enter once a return above it is achieved, aided perhaps by breaking news about vaccine effectiveness against the new strain. Alternatively, investors may wait for another bounce off $53.350. However, suppose the $1 million level cannot keep its promise, and there is other bad news. In that case, a six per cent drop towards the $50,000 psychological level and previous historical support are likely. Bulls will likely defend at that point against a further slide.

Can Ethereum Beat Bitcoin and Ripple?

The Ethereum price could outpace its peers and break new highs by the end of this week.

In just five days, Ethereum (ETH) bulls ran a tight and steep rally from $4,000 to $4,936, which was in an unfriendly marketplace with significant headwinds. That said, now that the bulls need to keep a firm stop on current ETH price action for a bull trap not to form after

After a brief reverse from its highs on Wednesday, ETH continued to test the December pivot at $4,481. That is just $16 above the chart's historical technical level up from November 12. That is a crucial level of significance, and it will be fascinating to see if bulls can keep price action above it with a possible rebound of the red.

A break below $4,465 would be suitable for bulls since it completes the descending channel established on April 11. However, if the bulls flee the scene, expect a bull trap to form and price to run down lower. The first support in question is the historical double top at $4,060, with the monthly S1 support level at $4,000 below that. The correction may already have absorbed 18% of any gains accrued from Wednesday's highs, which would entice investors looking for a bargain.

What Will Happen To Ripple (XRP)?

The bulls attempted to take control at $1.05 but were rejected, resulting in a retreat toward $0.88.

Ripple (XRP) Price Sparks Fly, But Then Hit a Roadblock on Wednesday The Ripple (XRP) price surged higher on Wednesday, although it hit a snag when the $1.05 support line held firmly following two failed tests to the upside. Tuesday's rejection, which squeezed prices downward, probably washed out a lot of investors and technical. As the price continues to decline, look for current market uncertainty to continue weighing on XRP and a possible retest of the near-term double bottom at $0.88.

https://www.youtube.com/watch?v=aohu2hJ8Cto

A break appears to be very probable on a retest of that double bottom, given the level's lack of historical or other significance. Bears would have an excellent opportunity to push the XRP price down toward $0.84 in the 3rd test of support at that level, or breakthrough and fall to $0.80, which is a significant figure and the monthly S1 pivot support level, coupled with a historical-critical support level of $0.78 set on June 8. If a trader buys bitcoin and sells their holdings of XRP, this would be an excellent location for a fade-in trade.

Due to the difficulties that Ripple is now experiencing, all price predictions are uncertain. However, if the SEC lawsuit against them is resolved in their favor, current forecasts will make sense.

Final Thoughts

The future is here, and it’s up to you to decide how much of your digital wealth should be invested in cryptocurrency. Keep in mind that any predictions made should not be taken as financial advice. Rather, they are meant to provide an overview of what could happen with these currencies in the coming years.

Leave a Reply

80 comments

Add comment ×