Bank of England Reports Warning to Cryptocurrency Investors

The Bank of England, one of the most influential banks globally, has released a statement warning investors against investing in cryptocurrencies. They report several risks associated with digital currencies that could leave investors facing substantial losses. This announcement is likely to cause a significant decrease in the value of cryptocurrencies.

Let’s find out if this is worth believing here in The Top Coins.

A Review of Cryptocurrency Price Performance

The Bank of England has released a severe warning to investors about BTC (Bitcoin), Ethereum currency, Binance Coin (BNB), Solana, Cardano, and XRP.

In the same way, some market experts have forecast that Bitcoin might become worthless, warning investors to be prepared to lose everything.

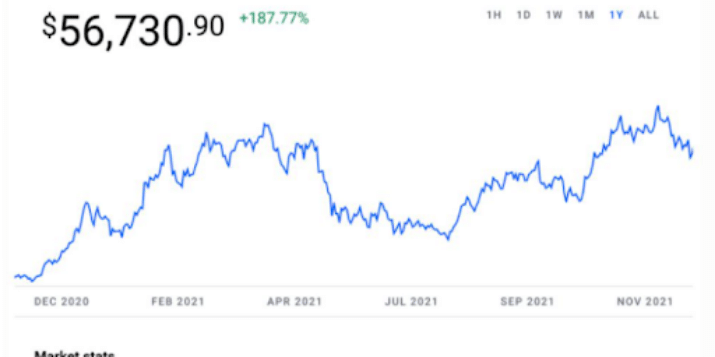

The price of the cryptocurrency market has increased significantly over the last year, in part due to the United States Federal Reserve's policy of ultra-low interest rates and massive cash injections into the financial system.

Start today to Forbes' CryptoAsset & Blockchain Advisor and discover exciting new NFT and crypto successes with the potential for 1,000% gains.

The Federal Reserve has been slowly lowering its bond purchases in recent weeks. Minutes from the Fed's most recent monetary policy meeting revealed that officials are considering further limiting quantitative easing measures.

After the big rallies this year, many investors appear to be getting a bit bearish. The price of bitcoin has grown by almost 200%, Ethereum's value has risen by 600%, and other cryptocurrencies like Solana, Binance's BNB, and Cardano have soared dramatically.

Today's Bitcoin prices dropped sharply, hitting a new all-time low and falling to less than $53,000, labelled as significant resistance.

The most expensive digital currency by market value, which has fluctuated as low as $51,808.54 this afternoon, according to CoinDesk data.

What Do the Experts Say?

The Financial Policy Committee of the Bank of England said that crypto assets are becoming more integrated with the broader financial system, and improved regulatory and law enforcement structures are required to handle risks.

Meanwhile, other bitcoin and cryptocurrency market experts have echoed Novogratz's worries.

Noelle Acheson, a digital prime broker's market insights leader, said: "This is not a one-off. It reflects a broader issue for the industry."

"This connects bitcoin to long-term real interest rates, which, if they stay low or even negative for a short period, would support further growth in risk assets. The danger is that real interest rates may rise to the point where they begin to stifle development and liquidity while still offering a better option than asset values in the broader market."

Despite these warnings over the bitcoin price, ethereum, and other cryptocurrencies, Novogratz thinks Wall Street and other significant financial institutions will continue to enter the bitcoin and cryptocurrency sector after this year's stampede.

According to a recent poll conducted by Nickel Digital Asset Management, institutional investors and wealth managers plan to boost their cryptocurrency exposure through 2022 and beyond.

Jerome Powell, the current Fed chair, has overseen one of the biggest monetary stimulus programs in the United States history to help offset the catastrophic economic consequences of the Covid-19 epidemic—which bitcoin and crypto prices have soared alongside with stock market enthusiasm.

Mike Novogratz, a billionaire crypto investor, has said that Powell's policies could result in a bitcoin and cryptocurrency market crash in 2022 as he attempts to curb runaway inflation.

"We have inflation showing up, you know, in pretty bad ways in the U.S.,"

On Tuesday, Novogratz told CNBC that even though bitcoin's price has dropped by about 60 percent in 2018 and is more than 70% down from its all-time high in December 2017, he believes it will bounce back.

The founder of Galaxy Digital Asset Management, a digital assets management firm focused on custody and intelligent contracts for institutional.

"That would slow all assets down, and it would slow the Nasdaq NDAQ -0.6% down. It would slow crypto down if we have to start raising rates much faster than we thought."

Despite lowering interest rates and launching large stimulus programs at the outset, central bankers worldwide are under more significant pressure to act as inflation rises.

What Should Investors Do?

After the Bank of England released a statement opposing cryptocurrency, some investors may be feeling anxious or uncertain about what to do next. Bitcoin prices dropped to almost a two-month low, so what should traders expect next?

Investors should not immediately sell their cryptocurrencies or stop investing in them. Investors need to research without letting the emotional roller coaster take over.

According to additional CoinDesk research, it was trading at its lowest level since October 6.

Following this fall, the cryptocurrency recovered, increasing over $54,000 before again plummeting below $53,000 tonight.

At the moment, the digital asset was trading at roughly $53,000.

[Ed note: Cryptocurrency and token investing are highly speculative, lacking regulation. If you are contemplating it, be prepared to lose your entire investment.

Several experts have discussed this particular stage, emphasising its significance.

After the stark Federal Reserve warning, bitcoin and cryptocurrency prices plummeted by $300 billion—Ethereum, Binance Chain, Solana, Cardano, and XRP all in free fall.

Bitcoin prices have taken a beating, losing approximately $300 billion in value from the overall crypto market in just two days.

The bitcoin price plummeted to around $51,000 per bitcoin after recently trading at approximately $69,000—a loss of almost 30%. Other significant cryptocurrencies, including Ethereum, Binance's BNB, Solana, Cardano, and Ripple's XRP, have lost over 10% in just 24 hours due to the latest drop.

The short bitcoin and cryptocurrency sell-off, which coincided with significant stock market losses, followed a statement by renowned investor Louis Navellier that the widely anticipated Federal Reserve "tapering" might burst the bitcoin and crypto bubble.

Final Takeaway

The Bank of England's warning should serve as a reminder that investing in cryptocurrencies is not without risk. They also pointed out the difficulty of using digital currencies for everyday transactions given their volatility and lack of acceptance by significant retailers or financial institutions like banks.

It is still unclear what will happen to these new technologies. Still, it seems clear that investors should proceed with caution when considering an investment in this space until more information becomes available on how regulators plan to respond to them.

Leave a Reply

149 comments

Add comment ×